Risk management - Budget vs Contingency

Budget vs Contingency

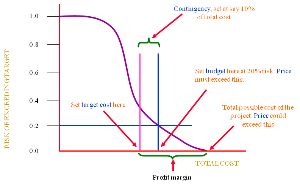

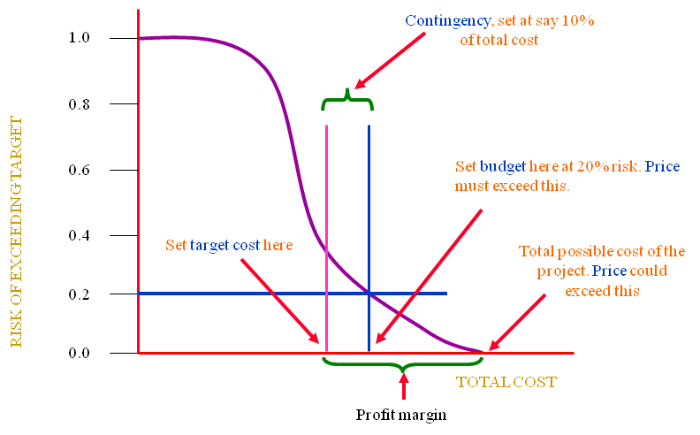

If we look at a typical output as above we might set the following:

Project budget

We could set this at 20% risk of exceeding it. Let us say the maximum total cost = £250,000. We might wish to set the PROJECT BUDGET = £200,000 having judged that this value has a 20% risk of being exceeded. This value will include any contingency.

This is the ‘cost’ you hope to complete the project for.

Customer price

The price quoted to a client MUST be higher than the project budget and can be even higher than the maximum total cost of £250,000.

However, in order to be competitive in the bid we might need to reduce the price accordingly.

Note: If a price has been given by the client as a guide and your assessment shows that setting a project budget at 20% will exceed this there are only a few options to pursue.

- Reduce the price further to allow for a margin of profit. This is very risky and could lead to substantial losses if the cost of the work does not come under what the calculations suggest.

- Review and revise the risk assessment.

- Don’t bid.

Contingency

At this stage, if the project budget is set at 20% and £200,000 this is what we believe is the best value whilst reducing the risk as much as possible.

However, if we wish to reserve (hold back) some of this budget as a contingency then the reduced amount would be the target budget.

Naturally, if the target budget is achieved there is less expenditure and more profit.

How do we judge the amount of this contingency?

One can use a simple % of the proposed budget e.g. this could be 10, 20, 25 or 30%.

This will have the effect of focussing the minds of the team to bring the project in on at a lower cost.

From a senior manager’s point of view this is a good thing to maintain this control over the project.

There can be some drawbacks in setting the level of the contingency.

It really depends on the curvature of the graph and its sensitivity, in terms of risk of the cost being exceeded, to small changes in the budget.

In the above case if we ‘hold back’ 10% for the contingency we can see that the project target cost then has approximately a 35% risk of being exceeded.

You may not consider this too bad. If you hold back 20% it may increase the risk to about to about 75%. As this will almost certainly be exceeded there may be little point in doing it as the contingency may be used up rapidly.

The aim is to set a target project total cost for the budget that has an element of risk but does not appear to be ‘impossible’.

If the original budget had been set at ‘10% risk of being exceeded’ (for example £225,000) then the target budget could have been set at ‘20% risk of being exceeded’.

This could be relatively easy to meet and so does not present much of a challenge.

See comments in this area from the viewpoint of the client [see Monte Carlo risk distribution].

Another method can be used to set the contingency [see Budget vs Contingency part 2].